After more than a decade of cheap borrowing, interest rates are rising. If you’re paying off a mortgage, making overpayments could save you money.

The Bank of England has increased interest rates to tackle high inflation. That means the cost of borrowing has increased and it could mean your mortgage costs you far more overall. If you have a tracker- or variable-rate mortgage, it’s likely the interest rate you’re paying has already increased this year.

If you’re in a position to do so, making regular mortgage overpayments could make financial sense.

The interest rate on your mortgage is likely to be higher than the rate your cash is earning if it’s in a savings account. So, reducing debt rather than saving more could help your money to go further.

Here are some pros and cons to weigh up if you’re thinking about making mortgage overpayments.

3 benefits of overpaying your mortgage

1. You can pay off your mortgage quicker

Overpaying your mortgage now means you can pay off the debt quicker.

As the overpayment you’ll be making will go directly towards reducing the debt, rather than paying interest, it can significantly shorten how long you’ll be paying it.

Let’s say you have a mortgage of £150,000 you’re repaying over 20 years. Overpaying £100 a month would mean you pay back the full amount 2 years and 10 months earlier.

It’s a step that can provide you with more flexibility later in life.

Paying off your mortgage doesn’t just come with financial benefits, as many people say it improves their wellbeing too. Knowing that you own your home can give you a sense of security.

2. It could reduce the amount of interest you pay overall

As the amount of interest you pay is based on outstanding debt, overpayments can mean you pay less interest. So, while your expenses will increase now, you’d be financially better off overall.

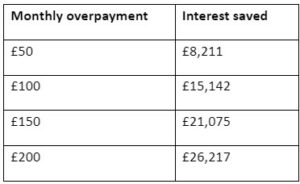

Let’s say you have a repayment mortgage of £200,000 over 25 years and an interest rate of 3.5%. Your repayments would be £1,002 a month. The below table highlights how regular overpayments would reduce the amount of interest you pay over the full term of the mortgage.

Source: MoneySavingExpert

3. You could access a better interest rate

In most cases, you will need to take out a new mortgage deal several times during the term to access competitive interest rates.

When you apply for a new mortgage, your loan-to-value (LTV) ratio will play a role. This measures how much mortgage debt you have compared to the value of your home. The lower the LTV, the more likely it is you’ll receive a better rate of interest, which would reduce your repayments and cost of borrowing.

So, by making overpayments and increasing the amount of equity you hold, you could secure a better mortgage deal in the future.

2 drawbacks to consider when overpaying your mortgage

1. You will have less flexibility

Once you’ve made an overpayment, you won’t be able to get that money back. So, if you faced an unexpected bill, you wouldn’t be able to use the money to cover it.

As a result, it’s a good idea to have an emergency fund before you start overpaying your mortgage. You should be confident in your ability to meet financial commitments and overcome a financial shock if the unexpected happens.

If financial flexibility is important to you, overpaying may not be the right option.

2. You could face fees when overpaying

You should read your mortgage terms before making overpayments. In some cases, you could face a fee.

Usually, you can overpay up to 10% of the mortgage debt before you face any additional charges if you have a mortgage deal in place. Unexpected fees could mean your overpayments don’t go as far or that it doesn’t make financial sense.

Once a mortgage deal has ended, you can usually make overpayments without charges. So, if you could face a penalty, saving your intended payments to pay off a lump sum once the deal ends may be right for you.

If you intend to overpay when taking out a new mortgage deal, a mortgage broker can help you find a lender that’s right for you.

Get in touch to talk about your mortgage needs

If you’re looking for a new mortgage, please contact us. We’re here to help you understand which mortgage could be right for you, including if you want to make regular overpayments.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.